Iniciar sesión/Registrarse

Tu correo electrónico ha sido enviado.

Parte de la información se ha traducido automáticamente.

ASPECTOS DESTACADOS

- Offer Deadline: December 11 by 5:00 p.m. (ET) | On-Site Inspections: Call to Schedule Appointments

- Attractive repositioning/medical reuse potential, including urgent care, dental, imaging, outpatient surgery, veterinary, behavioral health or med spa

- Properties can be acquired individually, in regional subsets, or as a portfolio, offering scalability & geographic diversification

- Portfolio consisting of six newly constructed or fully renovated facilities & one development parcel in strategic areas across five states

- ±7.05-acre land parcel in LaGrange, GA, is zoned CR-MX on a major thoroughfare, supporting mixed-use, commercial & multifamily development

- Features include dual walk-in freezers (-40°F), upgraded infrastructure, life-safety systems, dedicated parking, full fit-outs & flexible zoning

RESUMEN EJECUTIVO

This seven-property portfolio, presented by Hilco Global, consists of newly constructed or fully renovated facilities, as well as a vacant development parcel. Offers are due on December 11, by 5:00 p.m. (ET). Strategically located across five states, Michigan, New York, North Carolina, Illinois, and Georgia, these properties represent a unique opportunity to acquire modern, medically oriented buildings suitable for a wide range of adaptive reuse applications.

The portfolio is being delivered vacant, providing investors with immediate flexibility to re-tenant, repurpose, or reposition the assets for continued medical use, healthcare-adjacent operations, or traditional retail and commercial redevelopment. The properties’ sizes, layouts, and infrastructure also make them attractive for urgent care centers, diagnostic facilities, community health clinics, or outpatient clinic conversions.

Collectively, the portfolio encompasses approximately 70,000 square feet of gross building area on parcels ranging from one to seven acres. Each facility was purpose-built or extensively renovated, featuring cold storage, enhanced power, plumbing, HVAC, and life-safety systems. The sites are all high-visibility, freestanding locations within established retail or medical corridors, surrounded by complementary commercial activity and strong local demographics.

22981 Hall Road, Woodhaven, MI, is a ±11,460-square-foot building on a ±1-acre lot. It was built in 2001 and renovated in 2023, and is zoned B-3 General Business. The building is suitable for retail or medical office use, offering dedicated surface parking for visitors. It is highly visible within a strong retail corridor and located near major roadways, including Interstate 85 and West Road, providing convenient freeway access.

5516 Winona Street NW, Winston-Salem, NC, is a ±11,196-square-foot building on a ±1.74-acre lot. Built in 2024, it is zoned HB Highway Business. The property is suitable for retail or medical office use and is currently fitted for plasma donation. Additionally, it is located just minutes from the Wake Forest campus.

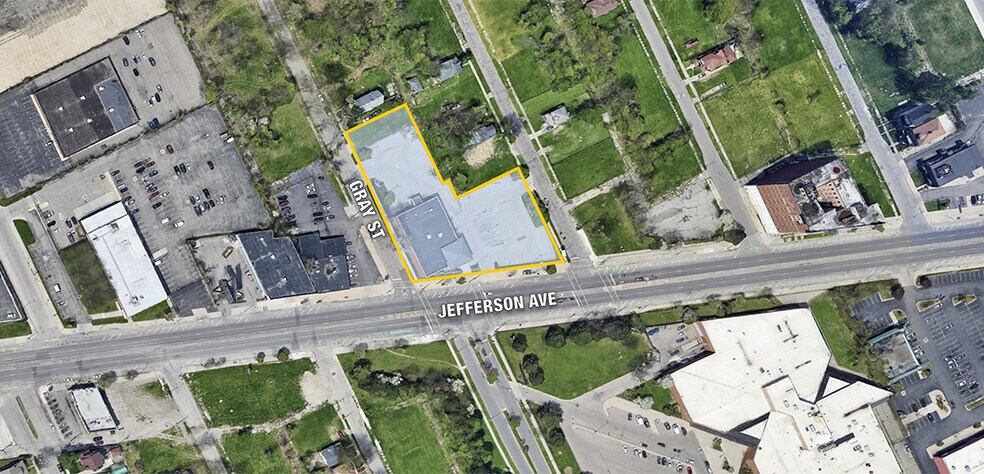

12907 E Jefferson Avenue, Detroit, MI, is a ±10,895-square-foot building on a ±1.43-acre lot. Built in 2000 and renovated in 2024, it is zoned B-4 General Business District. The facility provides ample surface parking with three dedicated access points. Formerly a CVS retail site, it has been retrofitted for plasma donation, offering future tenant flexibility.

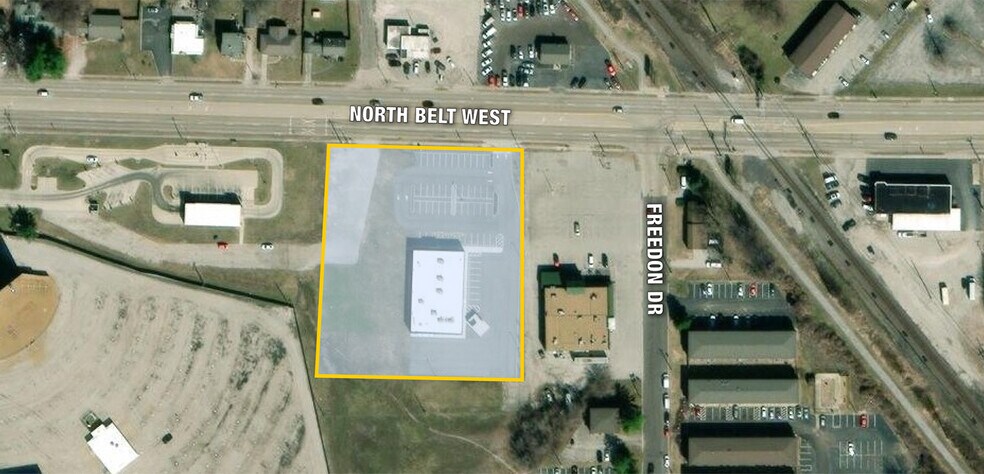

5510 N Belt West, Belleville, IL, is a ±8,952-square-foot building on a ±2.37-acre lot. Built in 2024, it is zoned C. The property benefits from access to transit and highways and is positioned in the St. Louis MSA near major employment centers. Nearby employers include sectors such as healthcare, education, manufacturing, retail and the U.S. military.

200/210 Main Street & 27 Lewis Street, Johnson City, NY, is a ±14,761-square-foot building on a ±0.85-acre lot. Built in 1986 and renovated in 2023, it is zoned GC to provide ample reuse potential. The property boasts plenty of surface parking, excellent visibility, and strong access to major roadways, including Interstates 81 and 86.

445–447 South Main Street, North Syracuse, NY, is a ±12,630-square-foot building on a ±1.18-acre lot. Built in 1954 and renovated in 2024, it is zoned C-2. The property features dedicated surface parking and four site access points. It is bordered by two major thoroughfares and offers easy access to Interstates 81, 481 and 90.

311 Commerce Avenue, LaGrange, GA, is a ±7.05-acre vacant development site zoned CR-MX. The property offers strong visibility with frontage on a major retail thoroughfare and is proximate to multiple national tenants. CR-MX zoning supports mixed-use, commercial, and potential multifamily development, providing flexibility for a variety of future development strategies.

In these markets, healthcare and social assistance consistently rank among the top three industries, underscoring steady demand for modern medical and service-related real estate across the country. Each location benefits from favorable demographics, with growing populations of working-age residents and healthcare-dependent households that reinforce long-term demand for outpatient and wellness services. Markets such as Syracuse, New York, and Winston-Salem, North Carolina, boast thriving regional healthcare systems anchored by major hospitals and universities, while areas like Detroit, Michigan, and Belleville, Illinois (just east of St. Louis) draw from strong institutional and research-driven employment bases.

These properties are being sold individually or in any combination. Offers must be received on or before the deadline of December 11, 2025, at 5:00 p.m. (ET) and must be submitted on the Letter of Intent (LOI). Enquire now to learn more.

The portfolio is being delivered vacant, providing investors with immediate flexibility to re-tenant, repurpose, or reposition the assets for continued medical use, healthcare-adjacent operations, or traditional retail and commercial redevelopment. The properties’ sizes, layouts, and infrastructure also make them attractive for urgent care centers, diagnostic facilities, community health clinics, or outpatient clinic conversions.

Collectively, the portfolio encompasses approximately 70,000 square feet of gross building area on parcels ranging from one to seven acres. Each facility was purpose-built or extensively renovated, featuring cold storage, enhanced power, plumbing, HVAC, and life-safety systems. The sites are all high-visibility, freestanding locations within established retail or medical corridors, surrounded by complementary commercial activity and strong local demographics.

22981 Hall Road, Woodhaven, MI, is a ±11,460-square-foot building on a ±1-acre lot. It was built in 2001 and renovated in 2023, and is zoned B-3 General Business. The building is suitable for retail or medical office use, offering dedicated surface parking for visitors. It is highly visible within a strong retail corridor and located near major roadways, including Interstate 85 and West Road, providing convenient freeway access.

5516 Winona Street NW, Winston-Salem, NC, is a ±11,196-square-foot building on a ±1.74-acre lot. Built in 2024, it is zoned HB Highway Business. The property is suitable for retail or medical office use and is currently fitted for plasma donation. Additionally, it is located just minutes from the Wake Forest campus.

12907 E Jefferson Avenue, Detroit, MI, is a ±10,895-square-foot building on a ±1.43-acre lot. Built in 2000 and renovated in 2024, it is zoned B-4 General Business District. The facility provides ample surface parking with three dedicated access points. Formerly a CVS retail site, it has been retrofitted for plasma donation, offering future tenant flexibility.

5510 N Belt West, Belleville, IL, is a ±8,952-square-foot building on a ±2.37-acre lot. Built in 2024, it is zoned C. The property benefits from access to transit and highways and is positioned in the St. Louis MSA near major employment centers. Nearby employers include sectors such as healthcare, education, manufacturing, retail and the U.S. military.

200/210 Main Street & 27 Lewis Street, Johnson City, NY, is a ±14,761-square-foot building on a ±0.85-acre lot. Built in 1986 and renovated in 2023, it is zoned GC to provide ample reuse potential. The property boasts plenty of surface parking, excellent visibility, and strong access to major roadways, including Interstates 81 and 86.

445–447 South Main Street, North Syracuse, NY, is a ±12,630-square-foot building on a ±1.18-acre lot. Built in 1954 and renovated in 2024, it is zoned C-2. The property features dedicated surface parking and four site access points. It is bordered by two major thoroughfares and offers easy access to Interstates 81, 481 and 90.

311 Commerce Avenue, LaGrange, GA, is a ±7.05-acre vacant development site zoned CR-MX. The property offers strong visibility with frontage on a major retail thoroughfare and is proximate to multiple national tenants. CR-MX zoning supports mixed-use, commercial, and potential multifamily development, providing flexibility for a variety of future development strategies.

In these markets, healthcare and social assistance consistently rank among the top three industries, underscoring steady demand for modern medical and service-related real estate across the country. Each location benefits from favorable demographics, with growing populations of working-age residents and healthcare-dependent households that reinforce long-term demand for outpatient and wellness services. Markets such as Syracuse, New York, and Winston-Salem, North Carolina, boast thriving regional healthcare systems anchored by major hospitals and universities, while areas like Detroit, Michigan, and Belleville, Illinois (just east of St. Louis) draw from strong institutional and research-driven employment bases.

These properties are being sold individually or in any combination. Offers must be received on or before the deadline of December 11, 2025, at 5:00 p.m. (ET) and must be submitted on the Letter of Intent (LOI). Enquire now to learn more.

FOLLETO DE VENTA

INFORMACIÓN DEL EDIFICIO

| Tipo de venta | Inversión | A la venta individualmente | 0 |

| Estado | Activo | Tamaño total del edificio | 6.462 m² |

| Número de inmuebles | 7 | Superficie total del terreno | 6,32 ha |

| Tipo de venta | Inversión |

| Estado | Activo |

| Número de inmuebles | 7 |

| A la venta individualmente | 0 |

| Tamaño total del edificio | 6.462 m² |

| Superficie total del terreno | 6,32 ha |

INMUEBLES

| NOMBRE DEL INMUEBLE/DIRECCIÓN | TIPO DE INMUEBLE | Tamaño | AÑO DE CONSTRUCCIÓN | PRECIO INDIVIDUAL |

|---|---|---|---|---|

| 311 Commerce Ave, Lagrange, GA 30241 | Terreno | 2,85 ha | - | - |

| 5510 N Belt W, Belleville, IL 62226 | Oficina | 832 m² | 2024 | - |

|

CVS Store 8277

12907 E Jefferson Ave, Detroit, MI 48215 |

Local | 1.012 m² | 2000 | - |

| 22981 Hall Rd, Woodhaven, MI 48183 | Local | 1.064 m² | 2001 | - |

| 5516 Winona St, Winston-Salem, NC 27106 | Oficina | 1.040 m² | 2024 | - |

| 200-210 Main St, Johnson City, NY 13790 | Local | 1.368 m² | 1986 | - |

| 445-447 S Main St, North Syracuse, NY 13212 | Local | 1.146 m² | 1954 | - |

ASESORES DE VENTA

Stephen Madura, Senior Vice President

Steve aporta una amplia experiencia en marketing inmobiliario y transacciones a Hilco Real Estate, tras haber participado en la venta de propiedades por valor de más de 500 millones de dólares en casi todas las clases de activos a lo largo de su carrera. Steve supervisa las operaciones, el marketing y la ejecución del equipo de ventas de activos. Sus responsabilidades incluyen la gestión de proyectos, la estructuración de acuerdos, la valoración detallada de las propiedades, el análisis de mercado y el desarrollo empresarial. Steve ha trabajado con particulares, inversores, promotores inmobiliarios, instituciones financieras, REIT, fondos de cobertura, fondos de capital privado, constructores de viviendas, la industria hotelera y del golf, proveedores de atención médica, propietarios de negocios y empresas estadounidenses como consultor inmobiliario y asesor estratégico. Los tipos de activos incluyen propiedades multifamiliares, de oficinas, industriales, minoristas, hoteleras, campos de golf, terrenos urbanizables y propiedades de uso especial en nombre de clientes de alto perfil. Steve también participa activamente en el ámbito de las quiebras y la reestructuración, representando a deudores, acreedores garantizados y fideicomisarios en los procedimientos contemplados en los capítulos 11 y 7 en todo Estados Unidos.

Michael Kneifel, Senior Associate

Michael Kneifel es asociado sénior de Hilco Real Estate.

1 de 15

VÍDEOS

MATTERPORT TOUR EXTERIOR EN 3D

MATTERPORT TOUR EN 3D

FOTOS

STREET VIEW

CALLE

MAPA

Elaborado por

6 Medical/Retail Conversion Opps & Land

¿Tienes cuenta con nosotros? Iniciar sesión

Parece que se ha producido un error al enviar tu mensaje. Vuelve a intentarlo.

Gracias. Se ha enviado tu mensaje.